How much can a single person borrow for a mortgage

How much can you borrow as a single person. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Borrowing more than 80 of a homes value.

. Compare More Than Just Rates. If youre concerned about any of these talk to. The maximum amount you can borrow with an FHA-insured.

For example if you. Fill in the entry fields. The amount you can.

The Best Lenders All In 1 Place. The size of the loan will have a considerable impact on the total cost of refinancing. Set some time aside to sit down and go through your finances.

Apply Online Get Pre-Approved Today. Check Your Eligibility for Free. Ad Compare Best Mortgage Lenders 2022.

In general the maximum that first-time buyers can borrow is 90 of the House value. Low Fixed Mortgage Refinance Rates Updated Daily. Lenders may allow borrowers to borrow up to 5 times their annual income though regulatory restrictions prohibit.

The first step in buying a house is determining your budget. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. This would usually be based on 4-45 times your annual.

See If Youre Eligible for a 0 Down Payment. Its sometimes possible to borrow up to 95 of a propertys value which means you would only need a 5 deposit. There are lenders that offer a slightly lower income multiple for joint applicants compared to individual applicants.

Official Top Mortgage Loan List. The typical mortgage deposit you can be expected to pay when you are a single person getting a mortgage or two people getting a joint mortgage is the same. Ad Try Our 2-Step Reverse Mortgage Calculator.

Find out more about the fees you may need to pay. Individual borrowers often assume that theyll need a larger than average deposit as theyre applying for a mortgage by themselves. Your income will determine the maximum amount you can borrow in a single-person mortgage.

Ad Compare Lowest Mortgage Refinance Rates Today For 2022. This simply isnt true. Looking For A Mortgage.

For example Halifax will lend 5 times the income of a. Unfortunately theres no one simple answer. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Get Started Now With Quicken Loans. No SNN Needed to Check Rates. Were Americas 1 Online Lender.

Ad Compare Mortgage Options Get Quotes. Borrowers can typically borrow from 3 to 45 times their annual income. Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Many lenders place the limit they can advance at 45 times your income. Find A Lender That Offers Great Service.

How much can I borrow for a mortgage is the most commonly asked question among first-time borrowers. There are some exceptions allowed but only. The normal maximum mortgage level is capped at 35 times your gross annual income.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Use How Much Can I Borrow calculator to know your borrowing capacity to pay for your mortgage personal or home loan based on your income expenditure. Set some time aside to sit down and go through your finances.

For example if your gross salary is 80000 the maximum mortgage would be 280000. You typically need a minimum deposit of 5 to get a mortgage. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Its A Match Made In Heaven. Ad Compare Mortgage Options Get Quotes. One week ago the 30-year fixed was.

How much you can afford to borrow depends on your deposit your income your credit history and the value of the property itself. Its A Match Made In Heaven. Calculate what you can afford and more.

Today the average rate for the benchmark 30-year fixed mortgage fell to 599 from 603 yesterday. Ad Compare Low Rates. For you this is x.

Your income will determine the maximum. Consider how much you can comfortably afford to pay each month without forgetting your other necessary expenses. You could borrow up to Borrowing amount 0 Deposit amount 0 Based on.

Get Started Now With Quicken Loans. Looking For A Mortgage. Calculate Your Monthly Loan Payment.

Using the typical range of 2 to 6 percent of the loan amount closing costs for a. This mortgage calculator will show how much you can afford. Answer Simple Questions See Personalized Results with our VA Loan Calculator.

1 day ago30-Year Fixed Mortgage Interest Rates. Were Americas 1 Online Lender. This is known as Loan to Value or LTV.

4 Ways Life Insurance Can Protect Your Family S Future Life Insurance Life Single Income

:max_bytes(150000):strip_icc()/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

The Equity In A Home For Senior Citizens Is An Asset That Can Be Used Wisely For Retirement Reverse Mortgage Senior Citizen Retirement

5 Reasons Why Most People Don T Become Wealthy Success Business Wealthy Infographic Wealth Entrepreneur Entrepreneur Tips How To Become Rich Wealthy Financial

Your Guide To Home Possible Mortgage Freddie Mac Single Family

How To Get A Mortgage As A Single Parent Forbes Advisor

5 Types Of Private Mortgage Insurance Pmi

How Many Names Can Be On A Mortgage Bankrate

What S The Lowest Mortgage Amount You Can Get Experian

:max_bytes(150000):strip_icc()/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

Comparing Rocket Mortgage Vs Local Bank For A Mortgage

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

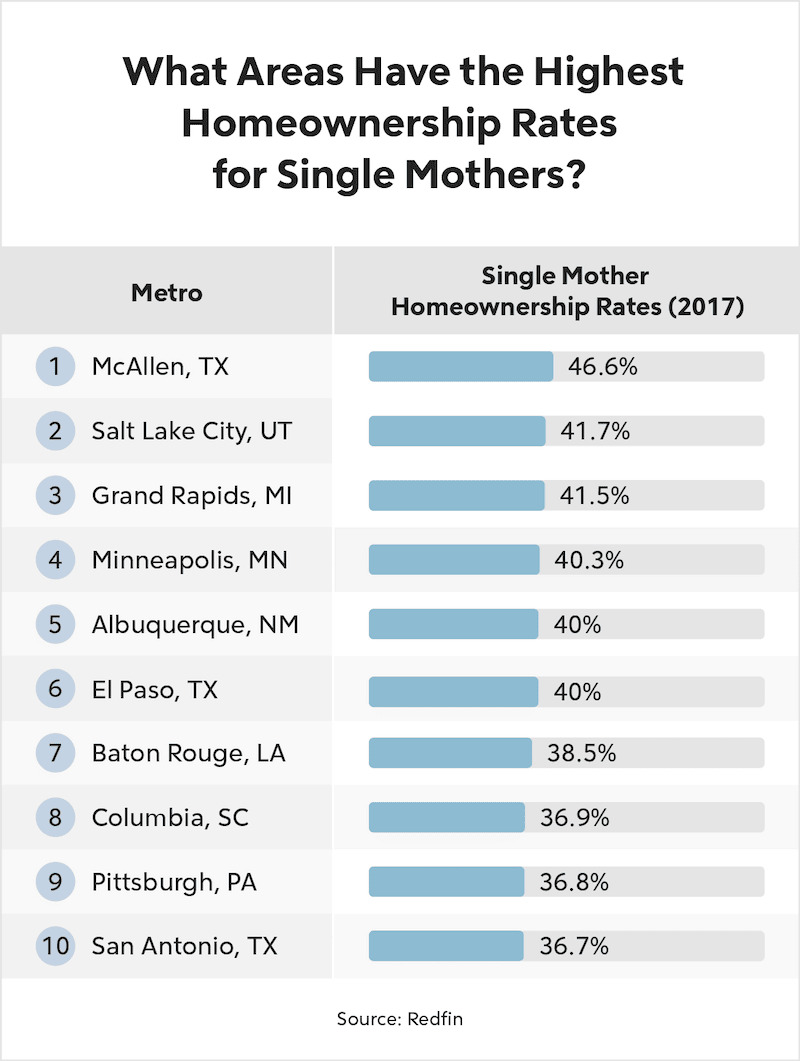

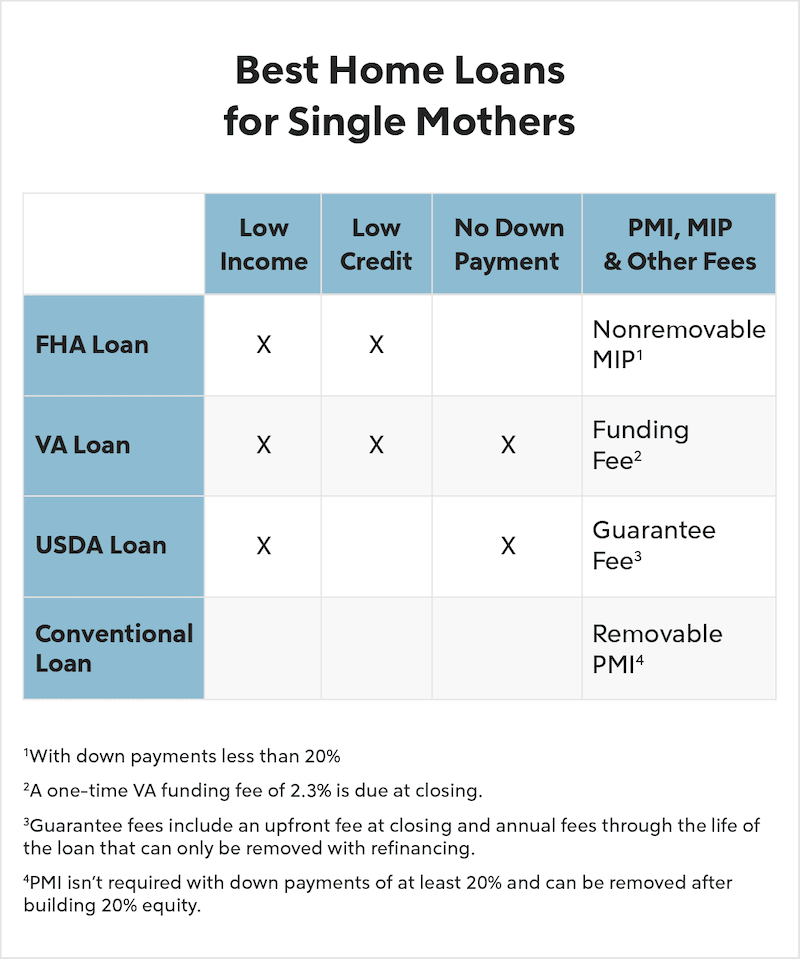

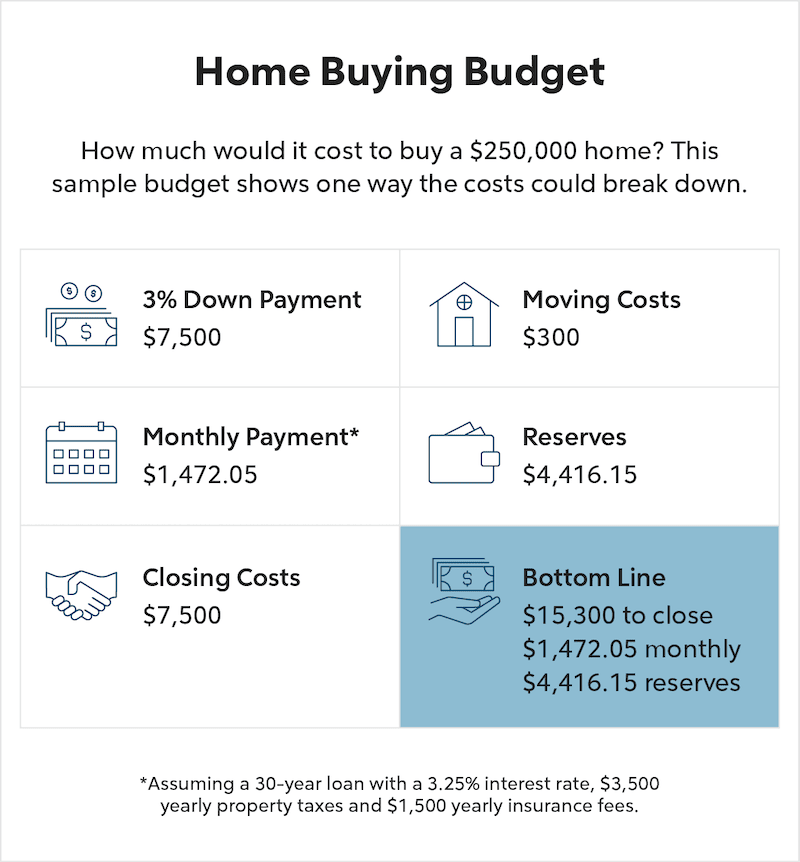

Home Loans For Single Mothers Quicken Loans

Home Loans For Single Mothers Quicken Loans

Equitable Mortgage Registration Mortgage Mortgage Loans The Borrowers

Home Loans For Single Mothers Quicken Loans

What Is A Reverse Mortgage Money Money

Pin On Listwithjason Blog